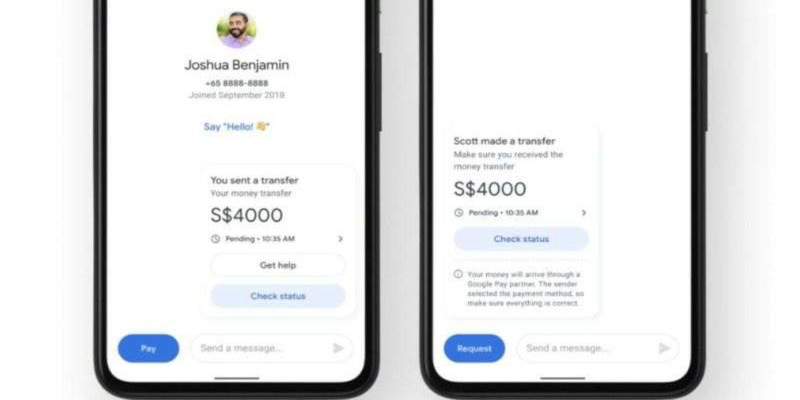

Google Pay users in India and Singapore can now receive money from users in the USA. The search giant has expanded its Google Pay features to now include remittance services – an industry that sees $700 billion worth of payments annually.

Google has teamed up with Western Union and Wise for this (formerly known as TransferWise). Users of Google Pay in the United States will be able to send money directly to Google Pay users in India and Singapore as a result of this. They choose to send using either Western Union or Wise at the time of sending.

While sending money, the exchange rate and transfer fee will be shown. The receivers in India and Singapore will receive the full sum that the US consumer wishes to give, with all charges imposed against the sender rather than the recipient.

As a result, when sending money from the United States, the consumer will be prompted to enter the exact sum they wish to submit. This number will be used to determine the charge and exchange rate.

By the end of the year, Google plans to extend this option to 200 countries.

“By the end of the year, we expect U.S. Google Pay users to be able to send money to people in more than 200 countries and territories through Western Union and more than 80 countries through Wise,” according to the company.

All Western Union transfers will be free from today until June 16 as part of the launch. In the case of Wise transfers, the first transfer would be free up to $500 for new customers.

Google, for one, will not charge a transfer fee.

It’s worth remembering that remittances can currently only be sent from the United States to India and Singapore, not the other way around.

Indians are the largest community of people who send money back home.

Indians are the largest group of immigrants who send money home, sending $78.6 billion in 2018, according to the United Nations’ International Organization for Migrants. China and Mexico came in second and third, with remittances of $67.4 billion and $35.7 billion, respectively.

With $68 billion in remittances, the United States remains the largest sender, followed by the United Arab Emirates and Saudi Arabia, with $44.4 billion and $36.1 billion, respectively.

Image courtesy: techviral.net

Leave a Reply